The activity of Red Sea merchant ships has sharply decreased, container freight rates on the Eurasian route continue to rise, and international shipping is facing a new threat of "the Mediterranean may be closed".

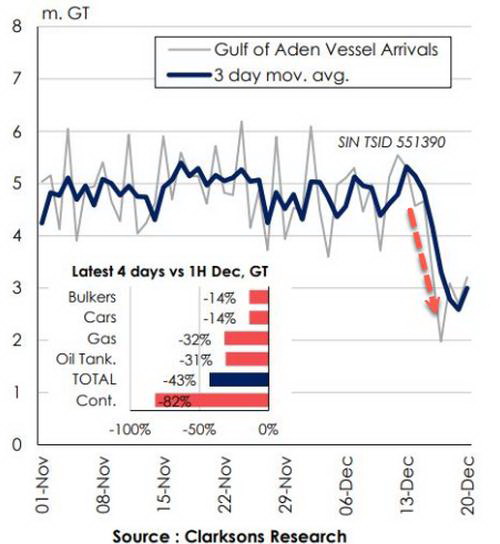

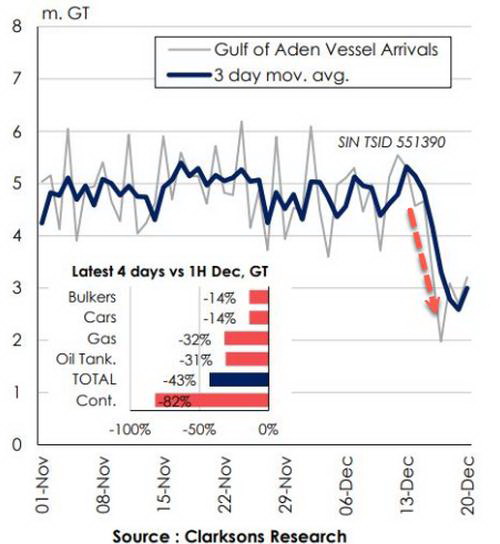

According to the latest data from Clarkson Research Services, the total tonnage of container ships arriving in the Gulf of Aden in the past four days has plummeted by 82% compared to the first half of this month.

The report released by Ningbo Shipping Exchange on December 22 shows that currently 85% of container shipping companies have notified the suspension of the loading of goods on the Red Sea route.

Many merchant ships heading to Eurasia have abandoned the Red Sea Suez route and diverted to Cape of Good Hope. Logistics company Kuehne+Nagel International AG released a report on Wednesday this week stating that at least 100 container ships have diverted near the Cape of Good Hope; This weekend, there will be more ships changing lanes.

This means that the distance and transportation costs of some commercial ships worldwide will significantly increase. According to media estimates, the overall range has increased by 40%, while transportation costs have increased by over 40%.

This has driven the domestic consolidation index and market freight rates to continue to rise. The main futures contracts of the consolidation index (European line) have hit the limit up for five consecutive trading days, with a cumulative weekly increase of over 50%.

The latest weekly report from the Shanghai Shipping Exchange shows that the comprehensive index of freight rates in the transportation markets of Asia Europe and other routes has risen by 14.8% to 1254.99 points; The Red Sea Route Index released by Ningbo Shipping Exchange also increased by 161.9% to 3649.5 points compared to last week.

The report shows that the freight rates for exports from Shanghai Port to the European and Mediterranean basic port markets have reached $1497/TEU (20 foot containers) and $2054/FEU (40 foot containers), and the freight rates for the Persian Gulf route have also reached $1477/TEU.

In addition, media data shows that the current Shanghai UK freight quote has jumped to $10000/FEU. And last week, the price was only $2400.

IKEA, a large home goods retailer, has encountered supply chain shortages due to extended shipping routes. IKEA spokesperson publicly stated:

"I can tell everyone that the situation with the Suez Canal will lead to transportation delays, which may cause supply restrictions on certain IKEA products."

"This is our top priority."

Previously, on this channel, which carries 12% of international trade and nearly one-third of global container transportation, there were 8.8 million barrels of oil and nearly 380 million tons of goods passing through every day.

Will the Mediterranean be closed?

According to the Securities Times, as of December 20th, several large shipping companies including Maersk, Herbert, Mediterranean, Delta Air Lines, and Evergreen Shipping have announced the suspension of the Red Sea Suez Canal route, taking a detour around the Cape of Good Hope, and at least 13 shipping companies have announced their detour plans.

At present, the Red Sea seems to be entering a "freeze period", with some supply chains at risk of paralysis.

According to a report cited by Shanghai Securities News, a commander of the Iranian Revolutionary Guard stated that if the United States and its allies continue to commit "crimes" in Gaza, the Mediterranean may be closed, but he did not explain how to do so.

According to the report,Tasnim News Agency quoted Brigadier General Mohammad Reza Nagdi as saying:

"They will soon wait for the closure of the Mediterranean, Gibraltar (Strait), and other waterways."